does texas have real estate taxes

50-69 percent may receive a 10000 exemption from the. A federal estate tax is a tax imposed by the federal government on the net worth of the.

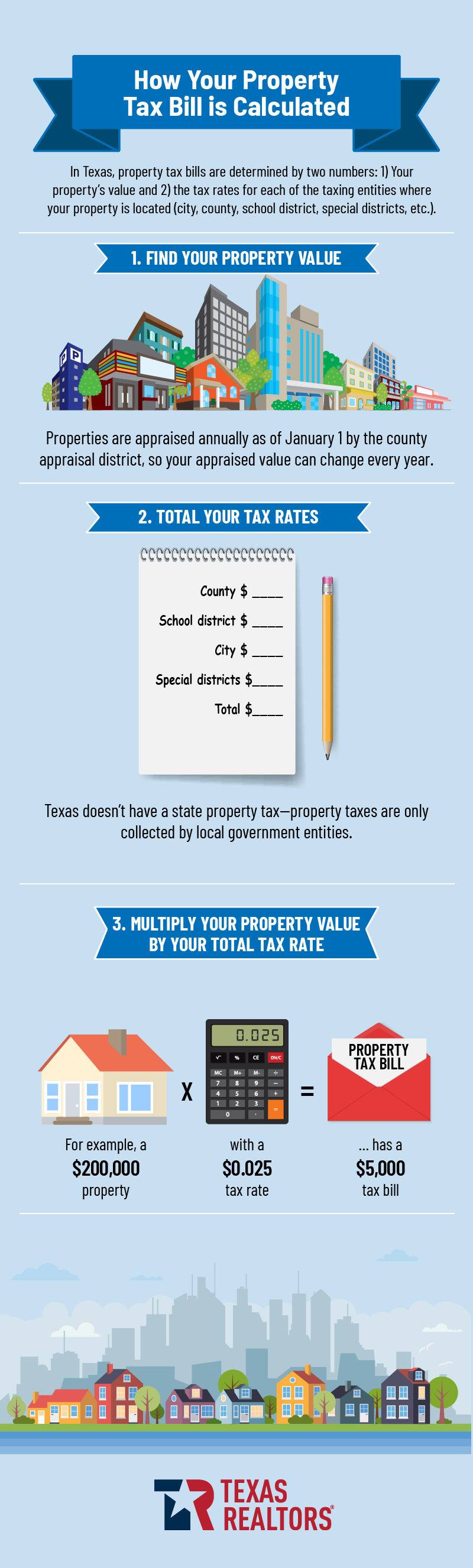

Property Tax Education Campaign Texas Realtors

Property tax in Texas is a locally assessed and locally administered tax.

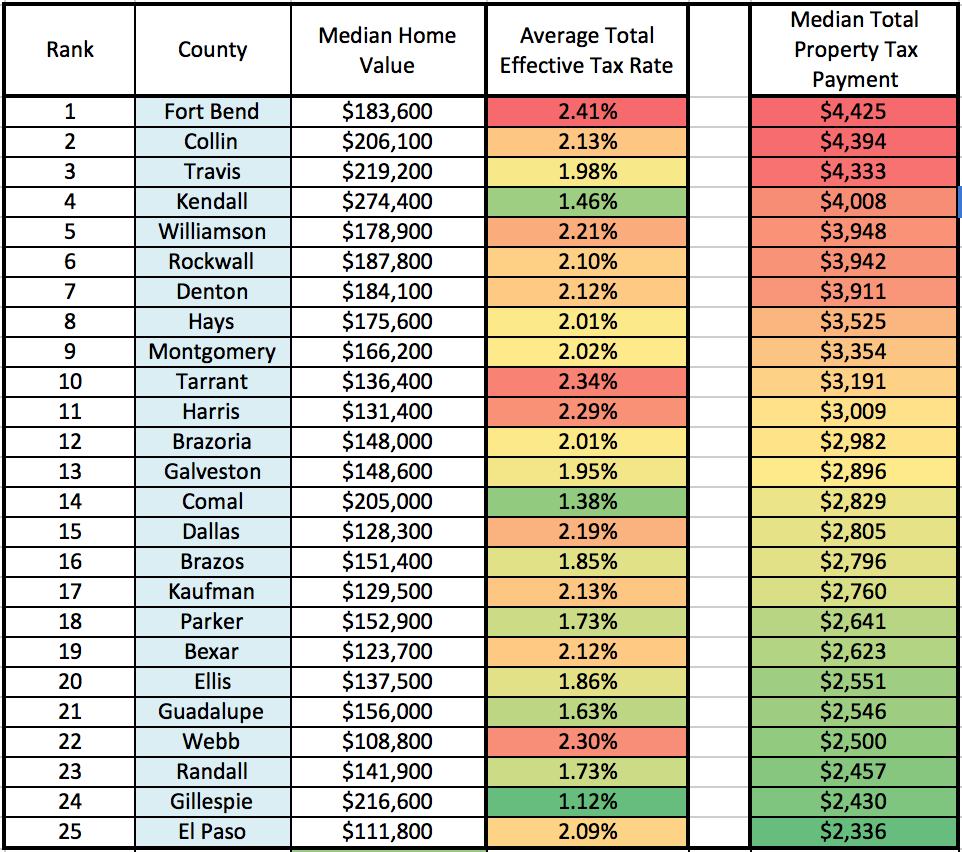

. Real property tax rates vary from state to state. Luckily in Texas there is no. These are some of the most expensive Texas counties property tax-wise.

The state of Texas does not have an estate tax however residents may still be subject to federal estate tax laws. Most local parishes add about 5 for an average total sales tax of about 10. The sales tax is 625 at the state level and local taxes can be added.

Taxing districts can also offer up to 20 reduction in a homestead value with reductions starting at 5000. Louisiana has a 445 statewide sales tax rate and local parishes can add up to an additional 7. Tax amount varies by county.

Texas has one of the highest average property tax. One of the important expenses most dont think about is capital gains tax. Real property tax is a system of taxation that requires owners of land and buildings to pay an amount of money based on the value of their land and buildings.

If you live in Texas and are thinking about estate planning. When selling your home you want to know how much you are going to net. There is no state property tax.

Although Texas has no state estate taxes it is subject to federal estate taxes. The rate increases to 075 for other non. Also keep in mind that in the state of Texas the most you can be taxed is 20 percent on your home sale.

Texas has no income tax and it doesnt tax estates either. This percentage applies if you make more than 434550 for single. In fact state and local governments use various methods to calculate your real property tax.

Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. 1 or as soon. Texas has the sixth highest.

How Is This Tax Calculated. Seniors qualify for an additional 10000 reduction in most cases. Its inheritance tax was repealed in 2015.

The median property tax in Texas is 181 of a propertys assesed fair market value as property tax per year. Tax Code Section 3101 requires the assessor to prepare and mail a tax bill to each property owner listed on the tax roll or to that persons agent by Oct. While the nations average property tax rate is 107 Texas homeowners have to pay much more.

Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and uniform setting tax rates and collecting taxes. Property tax brings in the most money of all taxes available to local governments. In Texas a veteran with a disability rating of.

70-100 percent may be able to deduct 12000 from their propertys taxable value.

Taxes On Sale Of A Home In Texas What To Consider

Property Taxes In Texas How To Protest Your 2021 Appraisal Wfaa Com

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

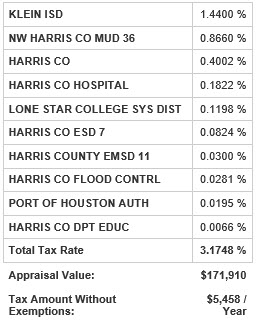

What You Need To Know About Spring Texas Real Estate Taxes Discover Spring Texas

/cloudfront-us-east-1.images.arcpublishing.com/dmn/5SS6QC6XS5B7NPRDZOIDRR4LZI.JPG)

May 7 Election Could Give Texas Homeowners Some Property Tax Relief

Over 65 Property Tax Exemption In Texas

Texas Property Taxes By County 2022

Tac School Property Taxes By County

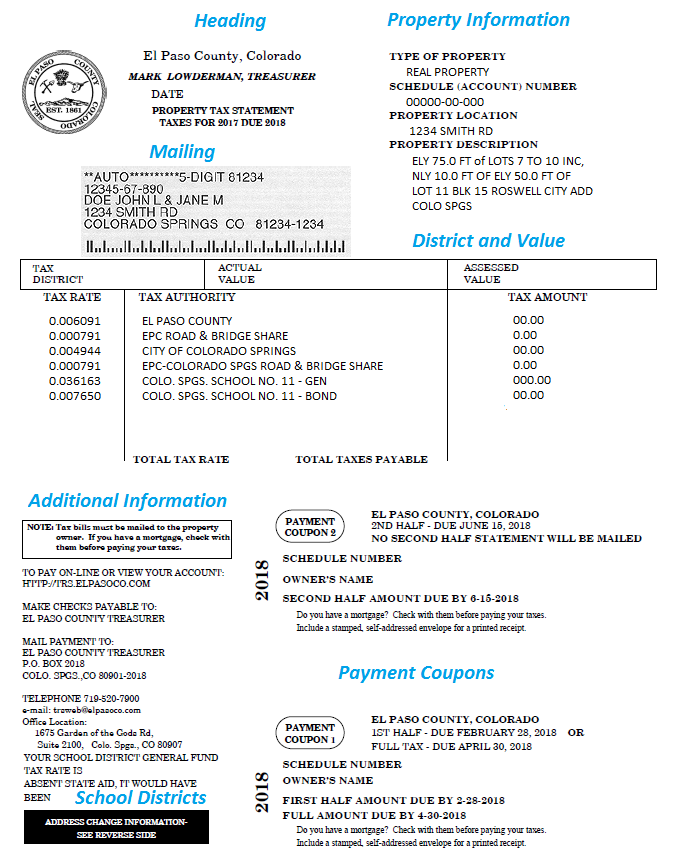

Property Tax Statement Explanation El Paso County Treasurer

The Ultimate Guide To Texas Real Estate Taxes

The Language In A May Vote To Lower Texas Property Taxes Is So Confusing That It S Incomprehensible

Texas Property Tax Sales In A Hybrid Tax Deed State Ted Thomas

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Protesting Or Appealing Your Property Tax Assessment In Texas

Texas Property Taxes Explained Texas Property Taxes Vs California Property Taxes Youtube

Where Do Texans Pay The Highest Property Taxes

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease